Running a small business is a whirlwind. You’re constantly juggling tasks, from sales and marketing to customer service and operations. It’s easy to let financial record-keeping fall by the wayside, but neglecting your finances can lead to serious problems down the road. One of the most critical financial documents for any small business is the balance sheet. It provides a snapshot of your company’s assets, liabilities, and equity at a specific point in time, offering valuable insights into your financial health.

While hiring an accountant is ideal, especially as your business grows, understanding the basics of a balance sheet is crucial even if you outsource the accounting. A well-structured balance sheet template can be a lifesaver. It helps you organize your financial data, track your performance, and make informed decisions about your business’s future. Think of it as a financial health checkup, allowing you to identify potential problems and take corrective action before they escalate.

This post explores the power of a small business balance sheet template, its key components, and how to use it effectively to manage your finances like a pro. Let’s dive in!

Understanding the Small Business Balance Sheet

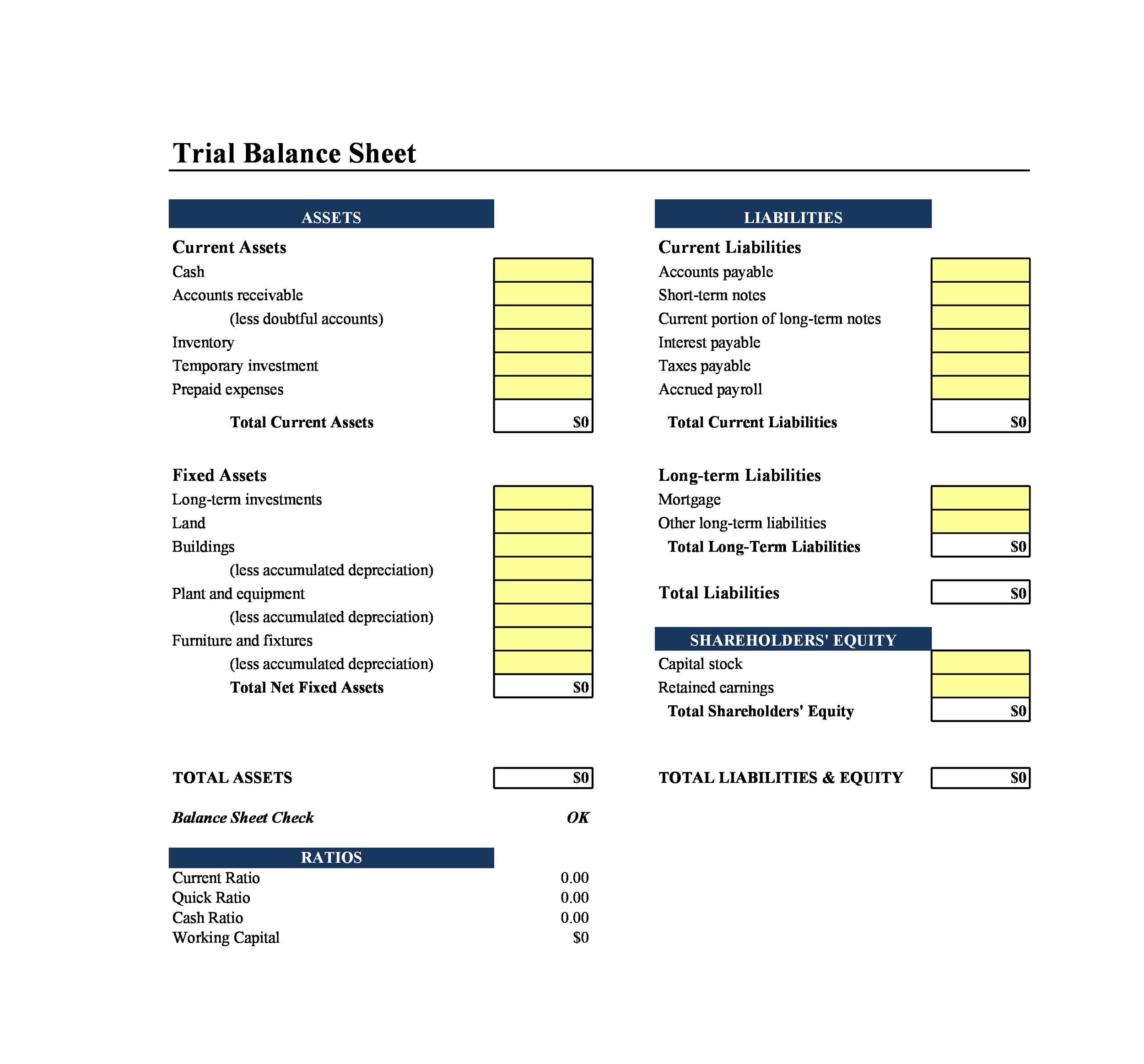

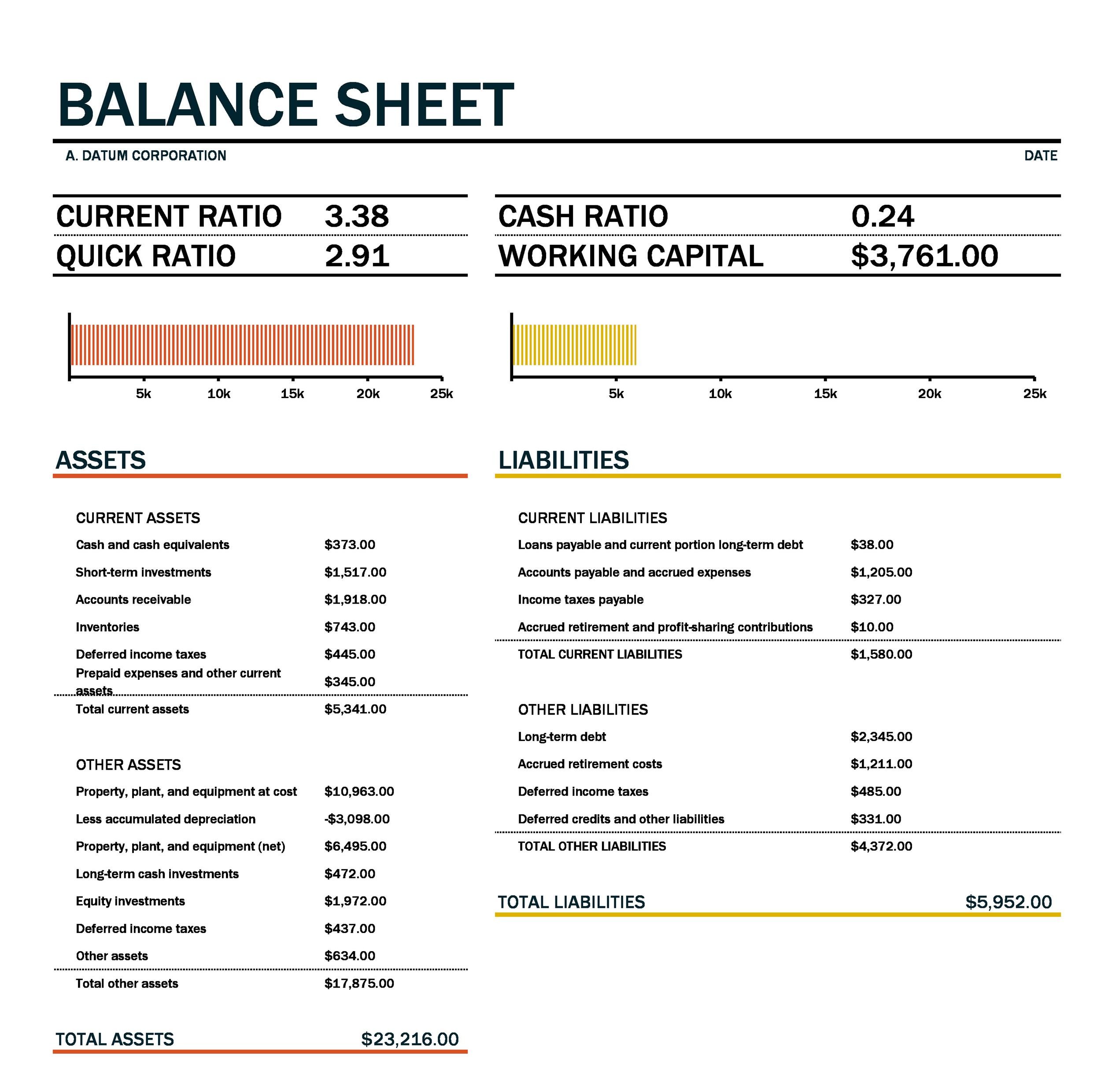

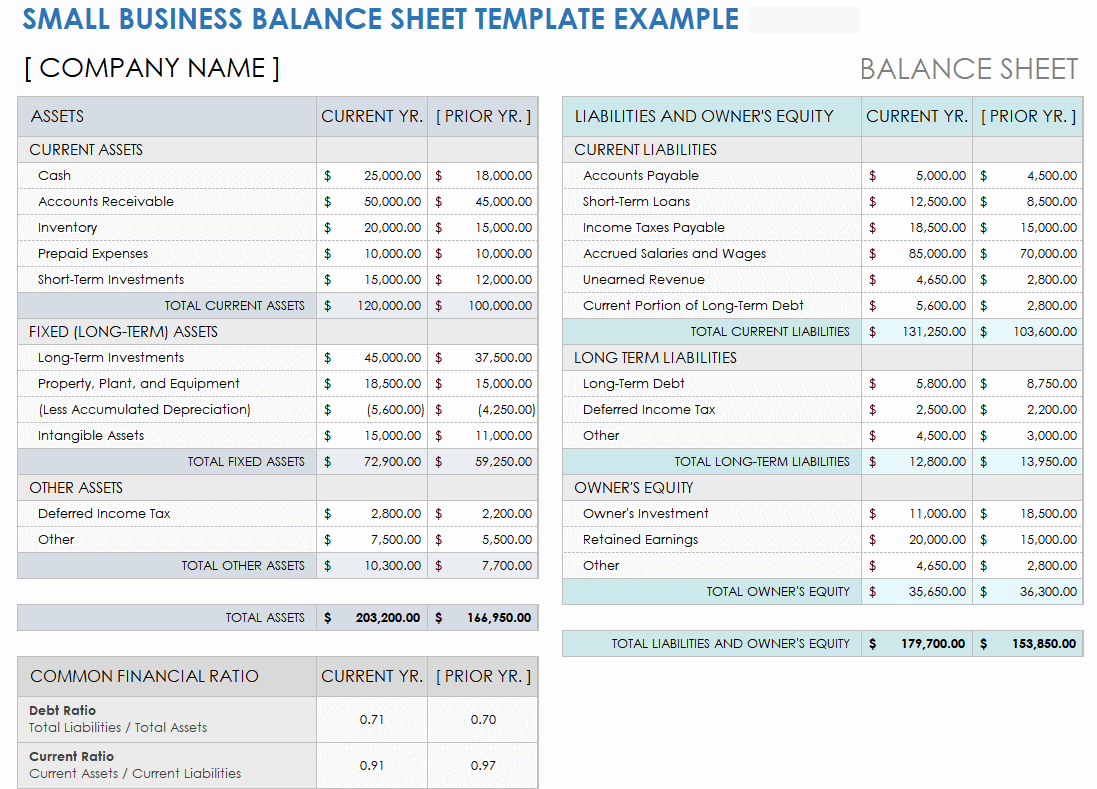

At its core, the balance sheet adheres to the fundamental accounting equation: Assets = Liabilities + Equity. This equation highlights the relationship between what your business owns (assets), what it owes to others (liabilities), and the owner’s stake in the business (equity).

What are Assets?

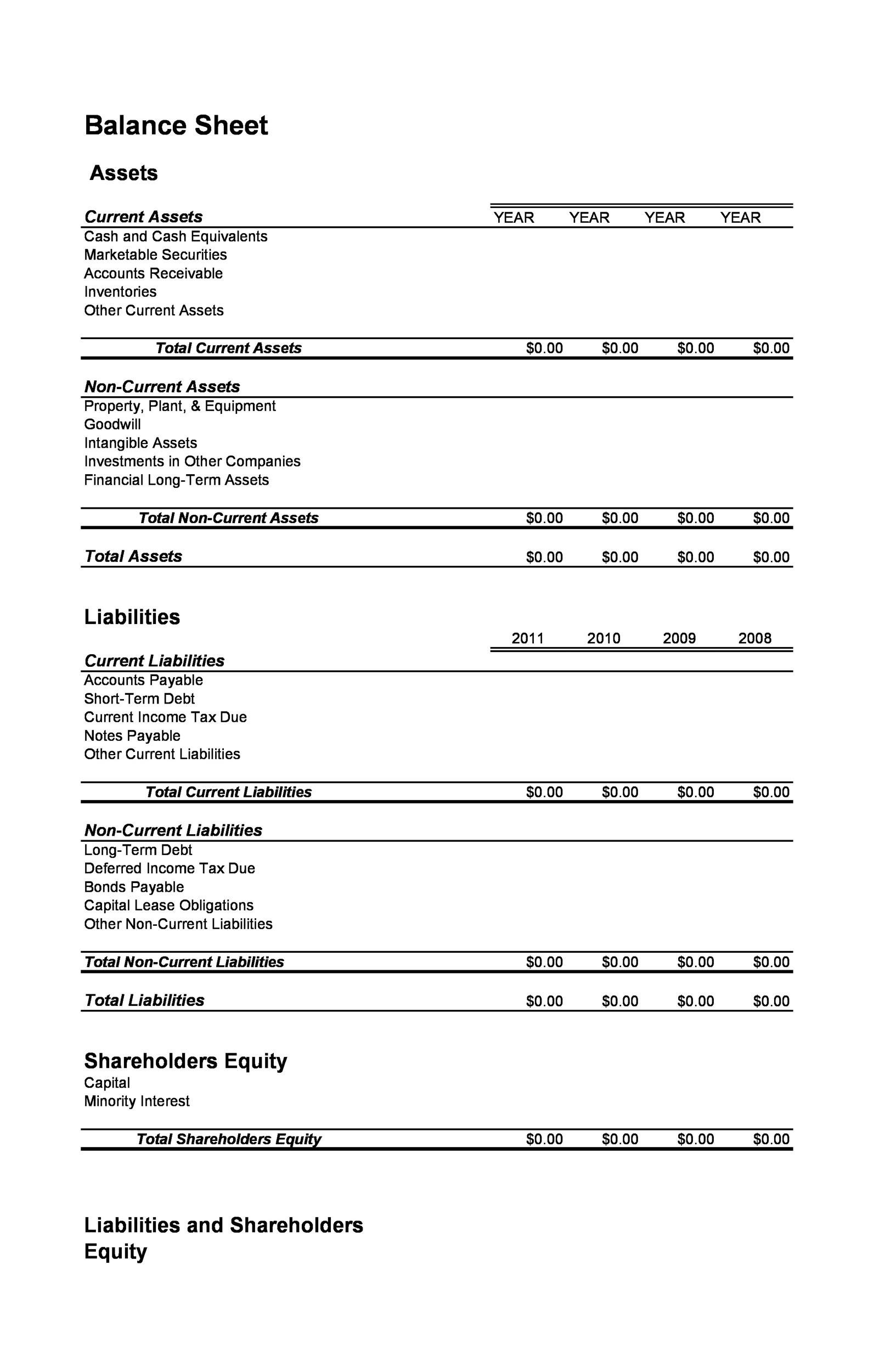

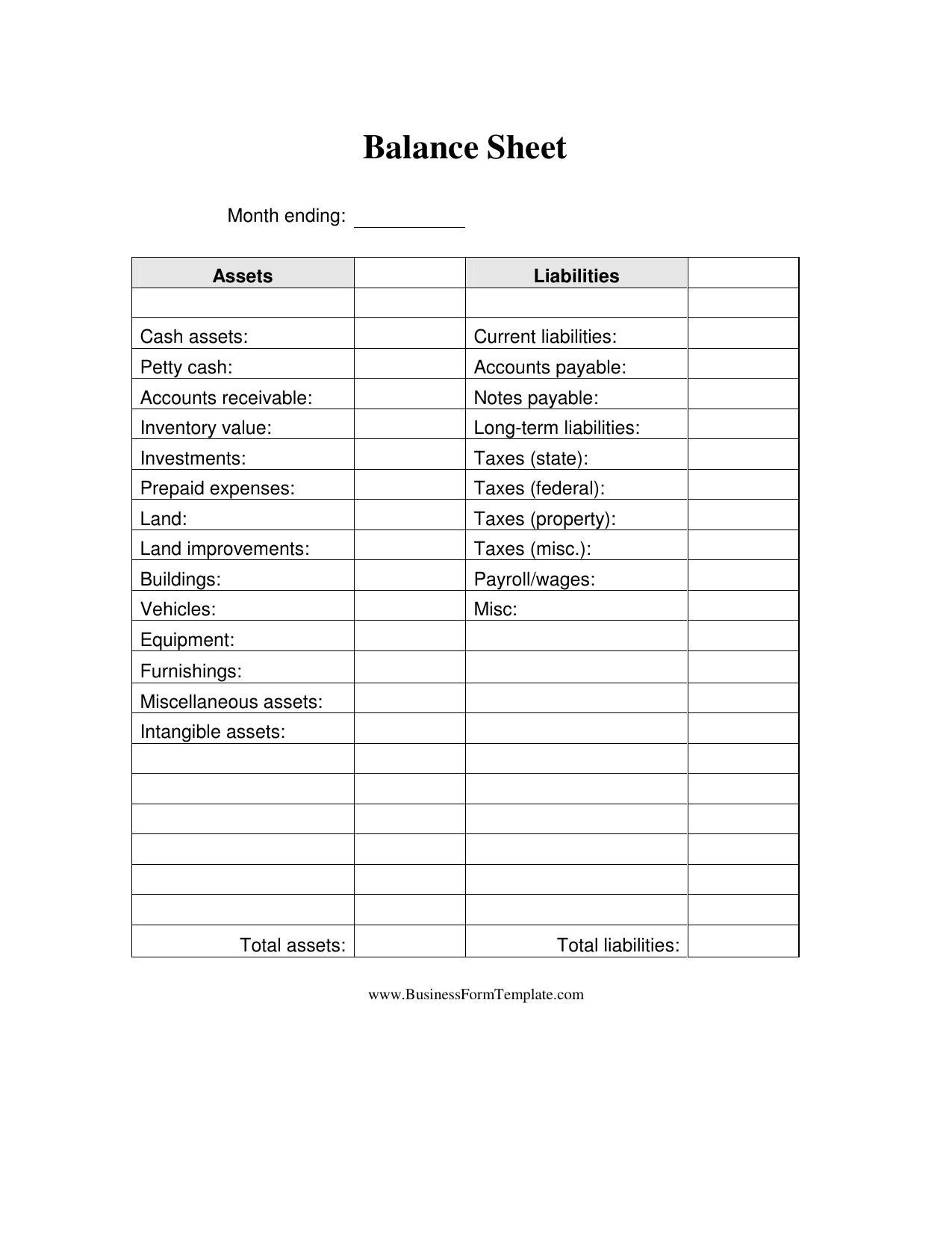

Assets represent the resources your business owns or controls that have future economic value. They are typically categorized as either current assets or non-current assets.

- Current Assets: These are assets that can be converted into cash within one year. Examples include:

- Cash and Cash Equivalents

- Accounts Receivable (money owed to you by customers)

- Inventory

- Prepaid Expenses (expenses paid in advance, like insurance)

- Non-Current Assets: These are assets with a lifespan of more than one year. Examples include:

- Property, Plant, and Equipment (PP&E)

- Long-Term Investments

- Intangible Assets (like patents and trademarks)

What are Liabilities?

Liabilities represent your business’s obligations to others. They are also categorized as current and non-current.

- Current Liabilities: These are obligations that are due within one year. Examples include:

- Accounts Payable (money you owe to suppliers)

- Salaries Payable

- Short-Term Loans

- Accrued Expenses (expenses incurred but not yet paid)

- Non-Current Liabilities: These are obligations that are due beyond one year. Examples include:

- Long-Term Loans

- Deferred Revenue

What is Equity?

Equity represents the owner’s stake in the business. It’s essentially what would be left over if you sold all the assets and paid off all the liabilities. For small businesses, this often includes:

- Owner’s Equity (for sole proprietorships and partnerships)

- Common Stock and Retained Earnings (for corporations)

The Power of a Balance Sheet Template

Using a balance sheet template provides numerous advantages for small business owners:

- Organization: A template provides a structured framework for organizing your financial data, making it easier to track your assets, liabilities, and equity.

- Consistency: Using the same template consistently ensures accurate comparisons over time, allowing you to identify trends and patterns in your financial performance.

- Financial Analysis: A well-populated balance sheet allows you to calculate key financial ratios, such as the debt-to-equity ratio and the current ratio, which provide insights into your company’s solvency, liquidity, and overall financial health.

- Decision-Making: The balance sheet provides valuable information for making informed decisions about investments, financing, and operational strategies.

- Investor and Lender Relations: A clear and accurate balance sheet is essential for attracting investors and securing loans. It demonstrates your commitment to financial responsibility and transparency.

Many free and paid balance sheet templates are available online, often in spreadsheet formats like Excel or Google Sheets. Choose a template that best suits your needs and accounting practices. Be sure the template includes all the essential elements mentioned above and allows for customization as your business grows.

In conclusion, a small business balance sheet template is an invaluable tool for managing your finances effectively. By understanding the components of the balance sheet and using a template consistently, you can gain valuable insights into your company’s financial health, make informed decisions, and set your business up for long-term success.

If you are looking for 38 Free Balance Sheet Templates & Examples – Template Lab you’ve visit to the right place. We have 22 Pictures about 38 Free Balance Sheet Templates & Examples – Template Lab like Free Small Business Balance Sheet Templates | Smartsheet, 38 Free Balance Sheet Templates & Examples – Template Lab and also Mastering The Basic Balance Sheet Template: A Guide For Financial. Here it is:

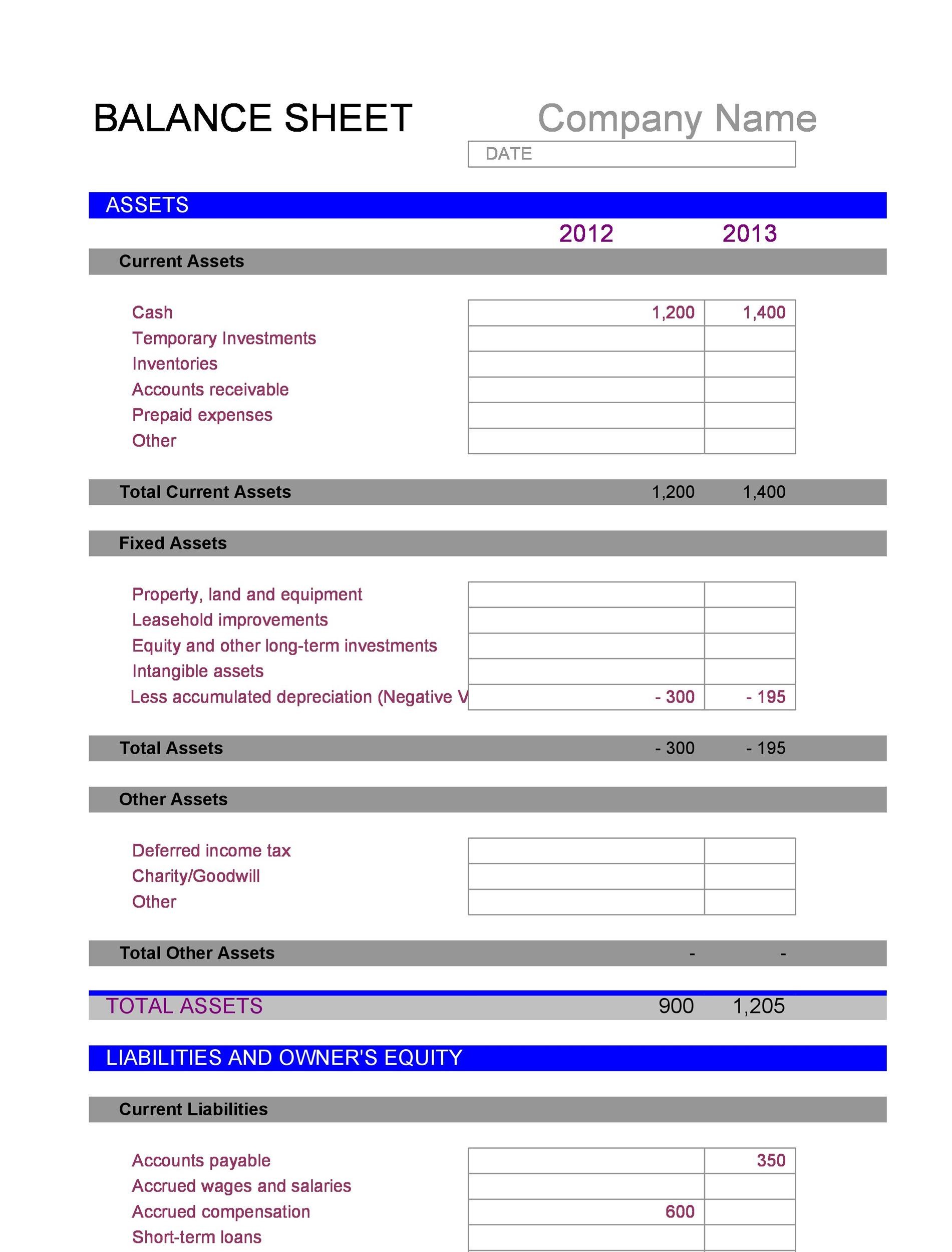

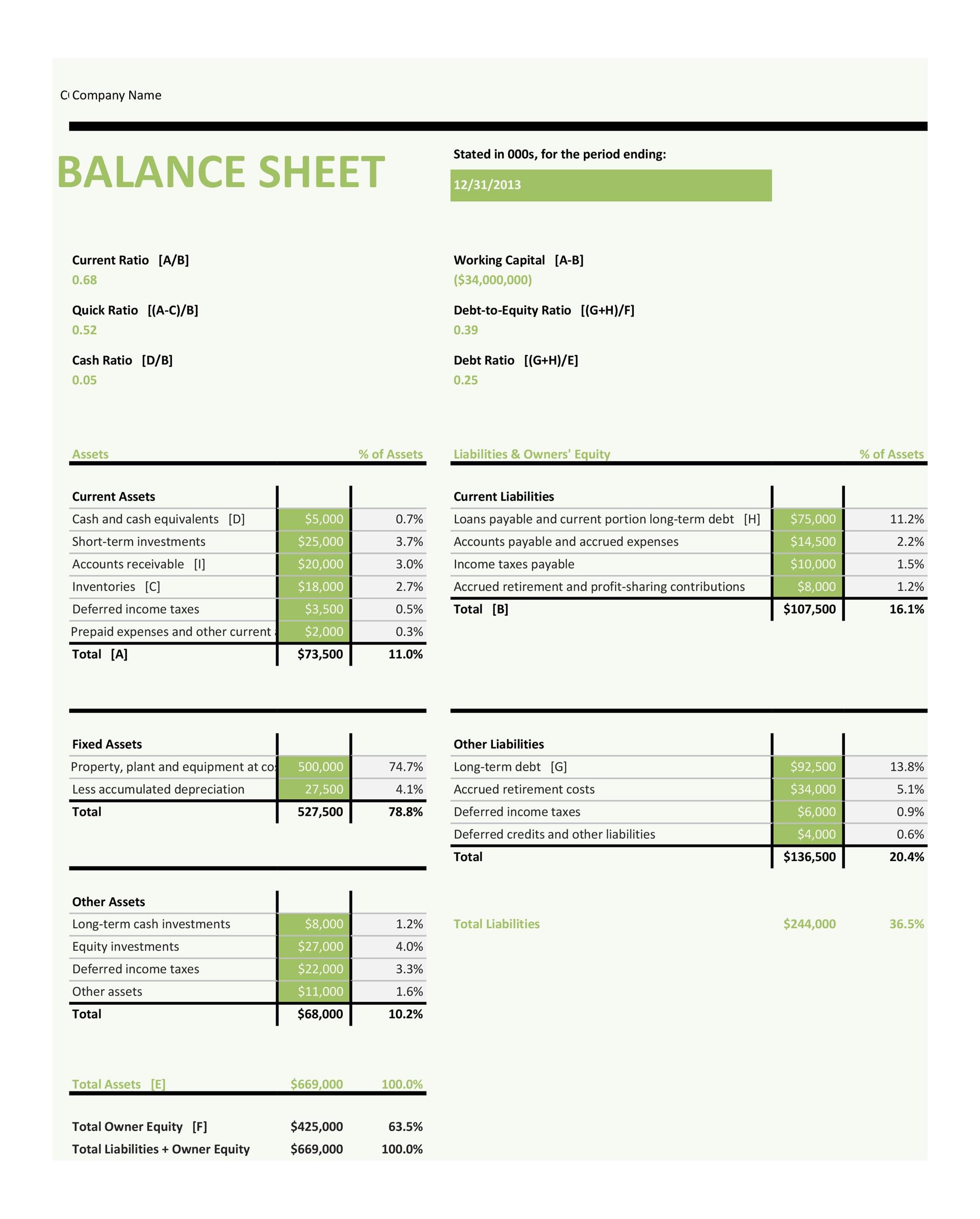

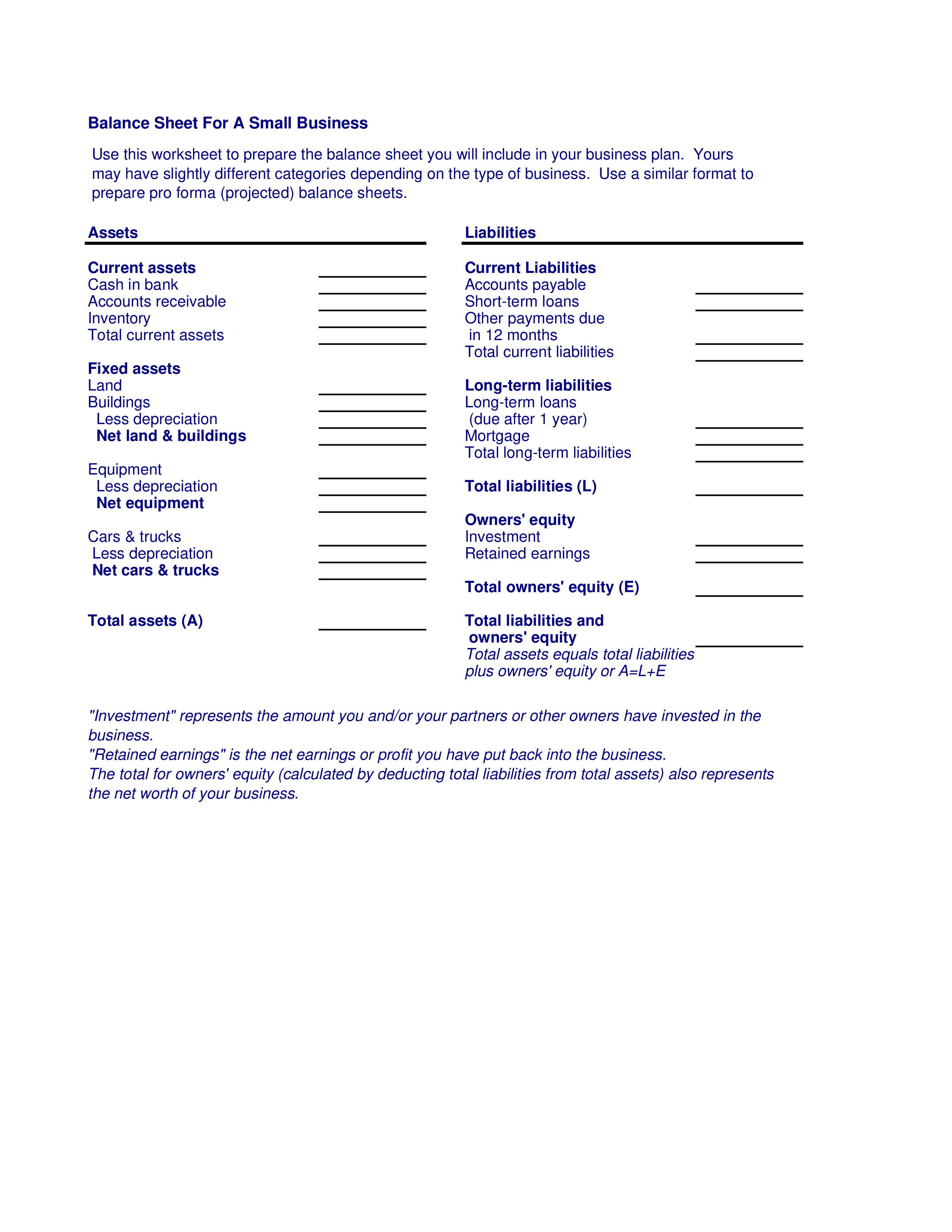

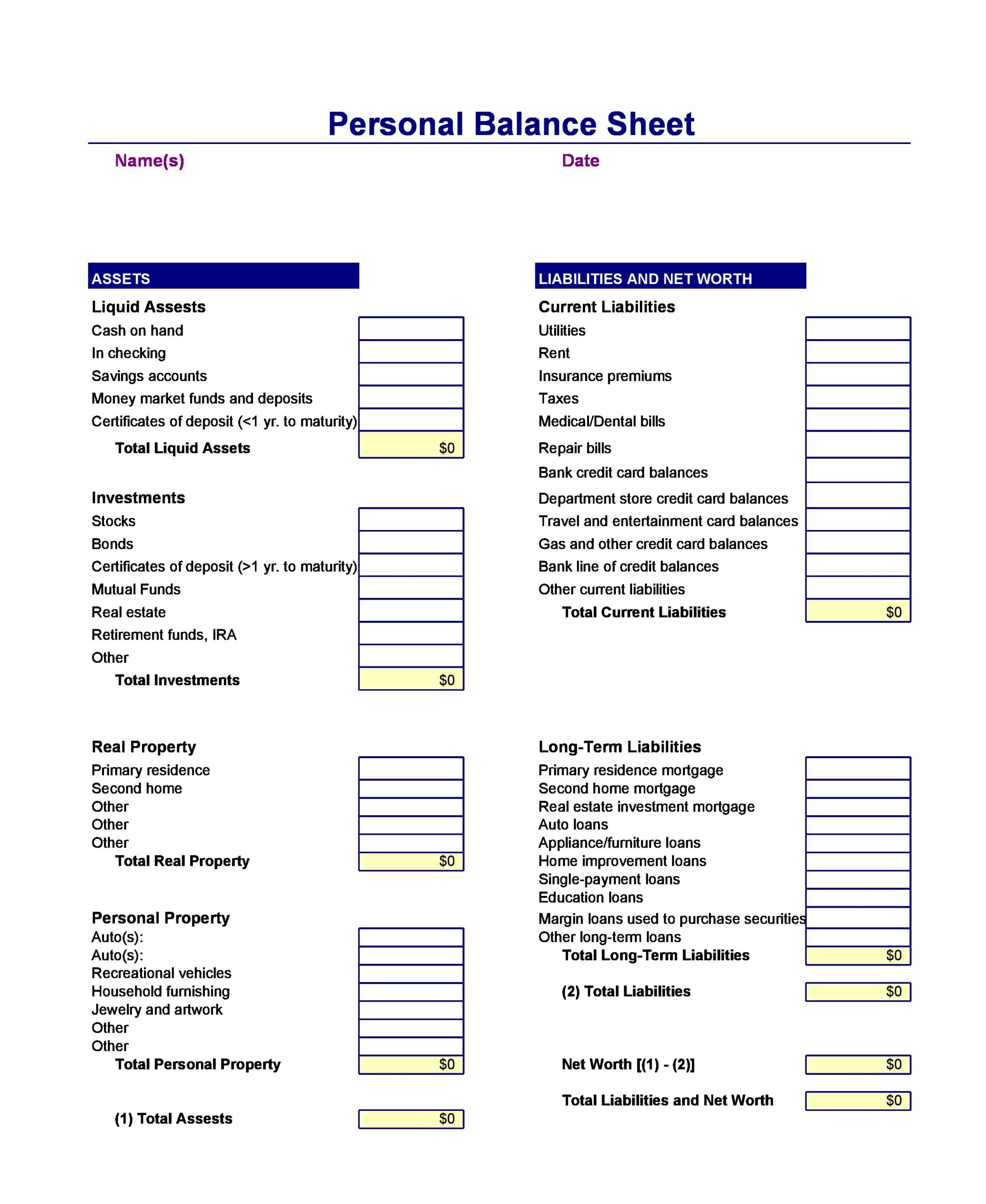

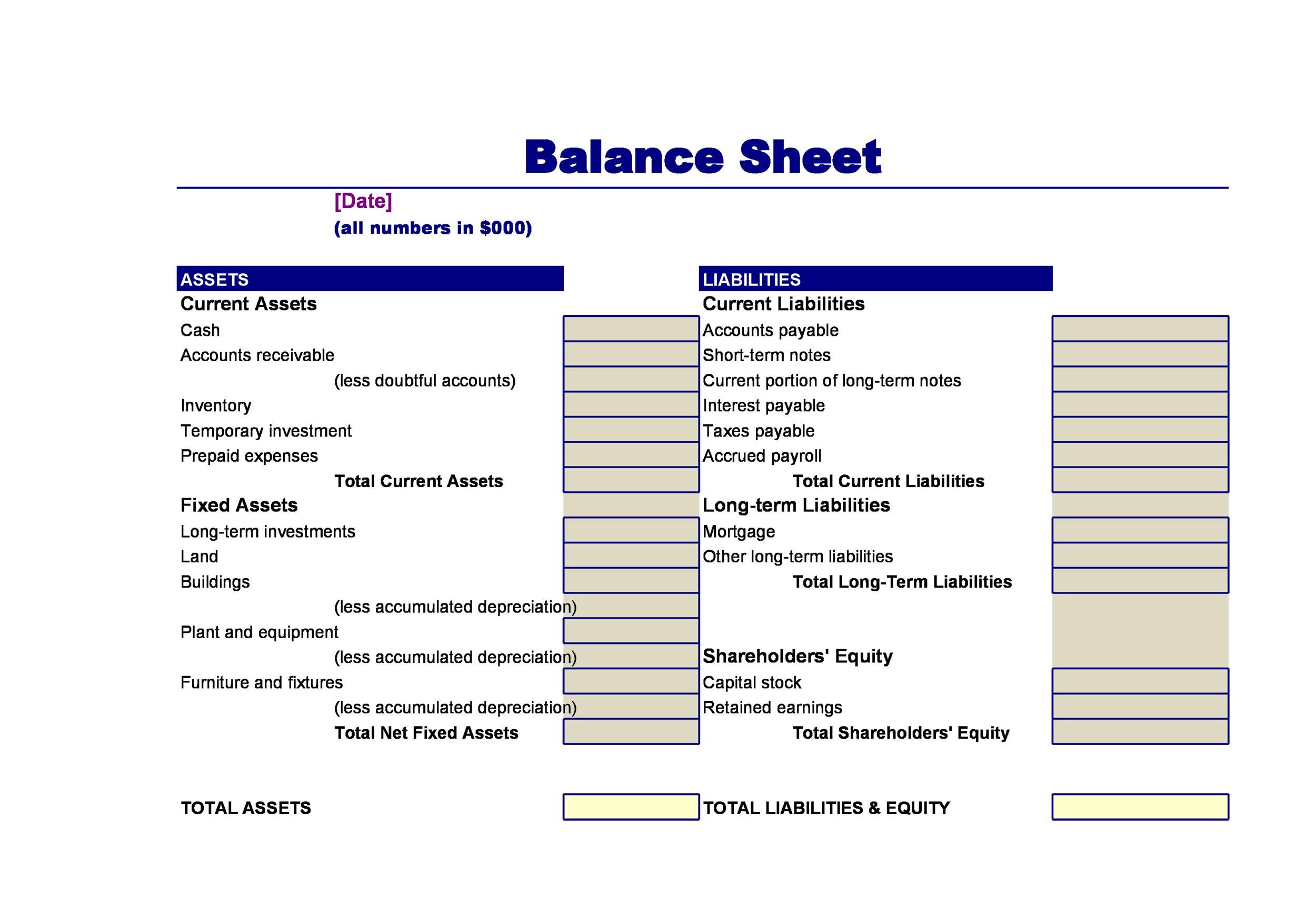

38 Free Balance Sheet Templates & Examples – Template Lab

templatelab.com

38 Free Balance Sheet Templates & Examples – Template Lab

templatelab.com

Balance Sheet Template, Small Business Balance Sheet, Financial

www.etsy.com

38 Free Balance Sheet Templates & Examples – Template Lab

templatelab.com

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

templatelab.com

Mastering The Basic Balance Sheet Template: A Guide For Financial

templatesz234.com

Balance Sheet For Small Business | Templates At Allbusinesstemplates.com

www.allbusinesstemplates.com

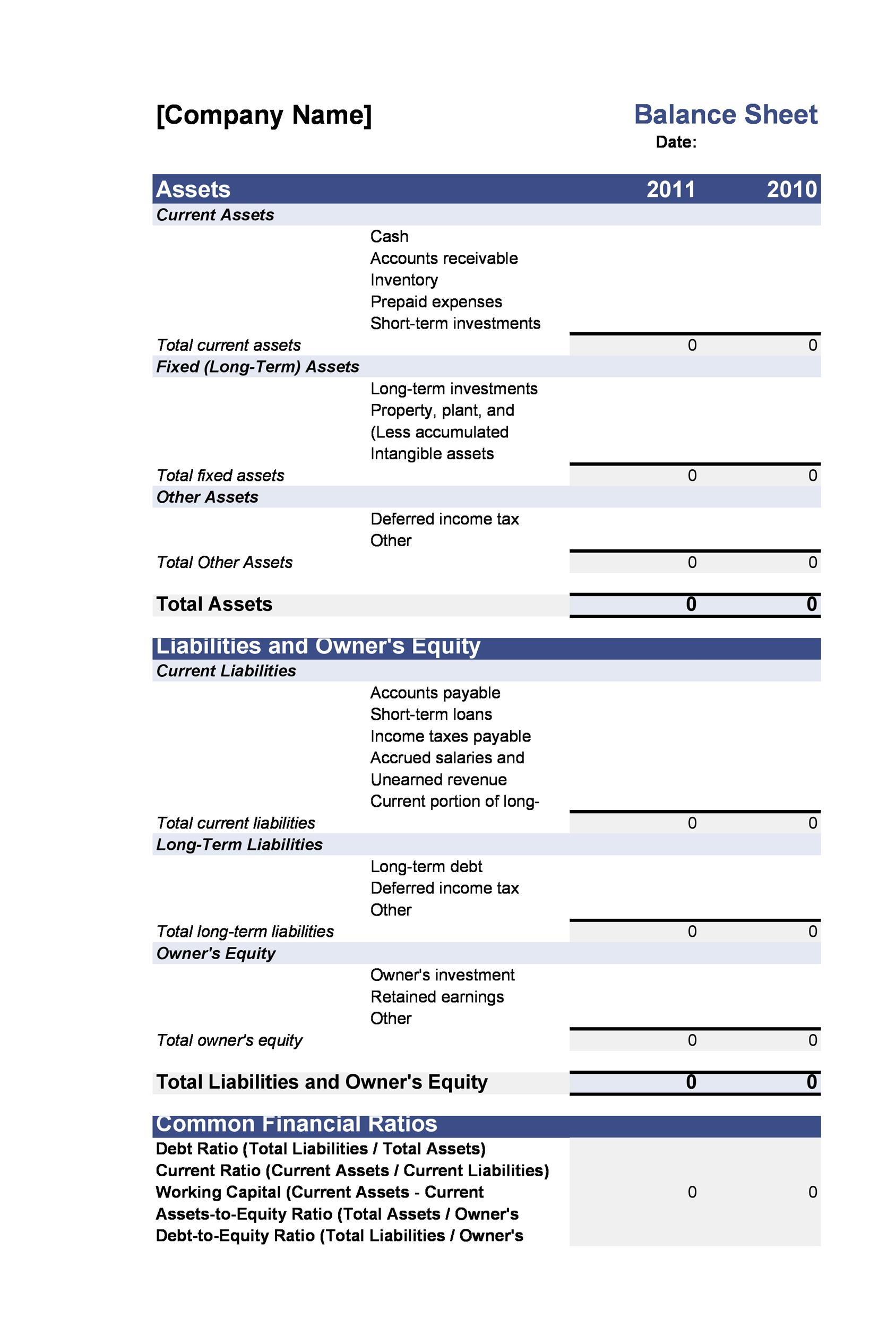

Small Business Balance Sheet Templates | Smartsheet

www.smartsheet.com

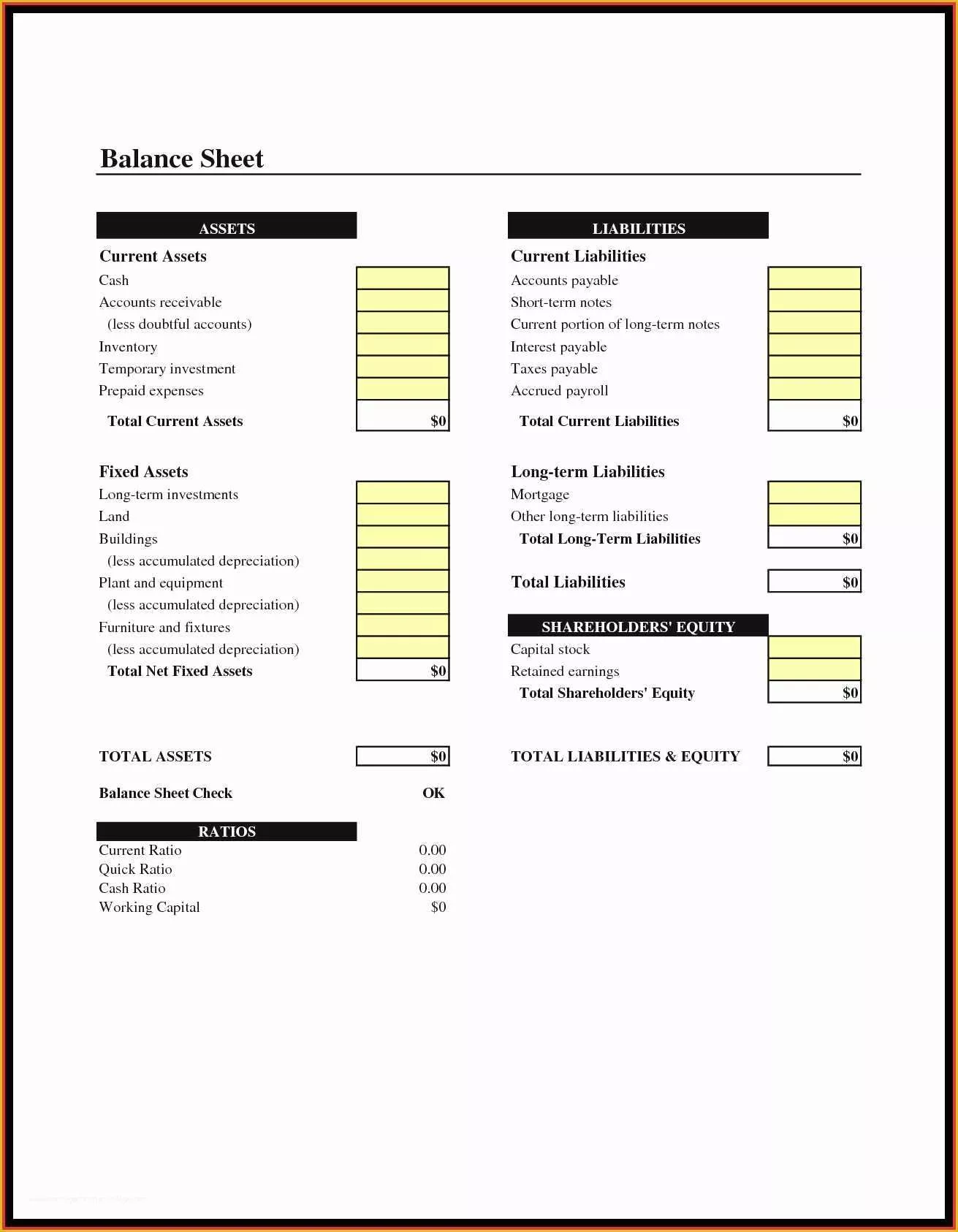

30 Simple Balance Sheet Templates (+Examples) – TemplateArchive

templatearchive.com

Balance Sheet Small Business Annual Report Excel Template And Google

slidesdocs.com

Free Balance Sheet Template Download – Wise

wise.com

38 Free Balance Sheet Templates & Examples – Template Lab

templatelab.com

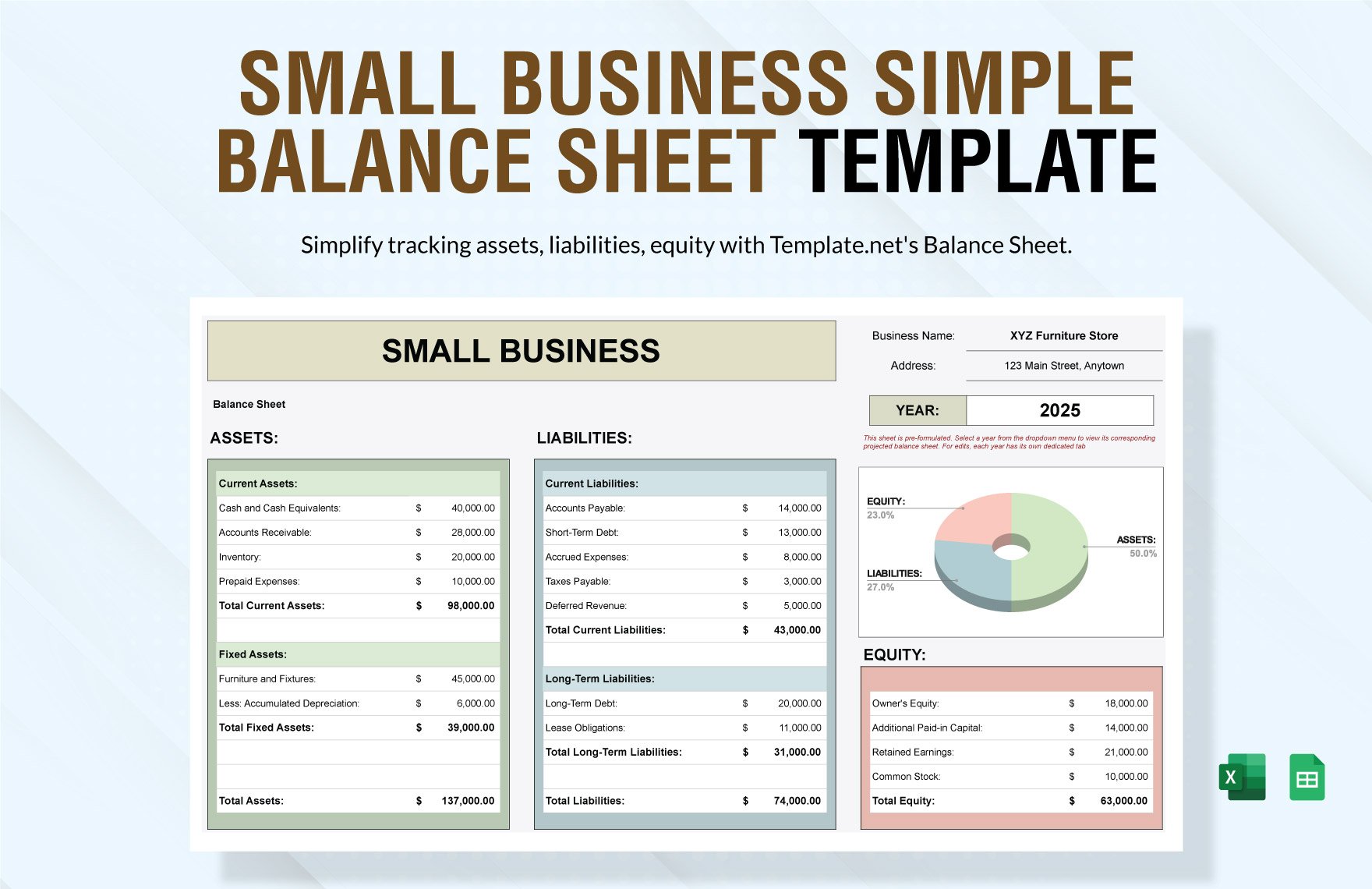

Free Balance Sheet Templates In Excel To Download

www.template.net

Editable Balance Sheet | Balance Sheet Template | Balance Sheet In

www.etsy.com

Small Business Balance Sheet Template – PARAHYENA

www.parahyena.com

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

templatelab.com

Free Printable Balance Sheet Template

old.sermitsiaq.ag

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

templatelab.com

EXCEL Of Simple Balance Sheet.xlsx | WPS Free Templates

template.wps.com

38 Free Balance Sheet Templates & Examples – Template Lab

templatelab.com

Editable Balance Sheet Templates In Word To Download

www.template.net

Free Small Business Balance Sheet Templates | Smartsheet

www.smartsheet.com

38 free balance sheet templates & examples. 38 free balance sheet templates & examples. 38 free balance sheet templates & examples ᐅ templatelab